Accumulation Phase — The Quiet Build

Accumulation is when professional capital—market makers, institutions, "smart money"—quietly builds positions before the move. The crowd isn't paying attention yet. But professionals are positioning.

What Is Accumulation?

Accumulation is the first phase of the AMD cycle. It's when market makers are quietly building their inventory—accumulating positions—without causing significant price movement.

During accumulation:

- Price often ranges or consolidates. Movement looks uncertain, choppy, or boring.

- Volume may be mixed or declining. The crowd isn't engaged yet.

- Sentiment is uncertain or negative. Retail traders are either bored or convinced the market is dead.

- Professional capital is positioning. Market makers are buying (for a long move) or selling (for a short move) without tipping their hand.

Why This Matters

What Market Makers Are Doing

During accumulation, market makers are building inventory. Here's what that actually looks like:

For a Long Move (Uptrend)

Market makers are accumulating long positions—buying inventory at lower prices before pushing price higher. They do this without creating obvious upward momentum that would alert retail traders and drive prices up prematurely.

How they accumulate: Absorb retail selling quietly, create small ranges where price oscillates, trigger retail stops to grab liquidity, buy during moments of retail pessimism.

For a Short Move (Downtrend)

Market makers are accumulating short positions—selling inventory at higher prices before pushing price lower. They do this without creating obvious downward momentum that would cause retail to sell (which would remove their counterparty).

How they accumulate: Distribute into retail buying quietly, create small ranges where price looks stable, trigger retail stops to create selling pressure, sell into moments of retail optimism.

How to Identify Accumulation

Accumulation doesn't announce itself. It's quiet by design. But there are patterns you can spot:

1. Price Consolidation After a Move

After a significant trend (up or down), price enters a range. Volume decreases. Retail traders lose interest. This is often accumulation forming for the next directional move.

2. Repeated Tests of Support/Resistance

Price repeatedly tests the same level without breaking through. Each test looks like a failure to retail, but market makers are using those tests to accumulate inventory from frustrated traders who exit.

3. Declining Volatility

Price ranges tighten. The market looks "dead." Retail attention drops. This is prime accumulation territory—professionals position while the crowd isn't watching.

4. Sentiment Extremes

Retail sentiment is either extremely bearish (accumulation for a long move) or extremely bullish (accumulation for a short move). When everyone agrees the market is "over," that's when market makers accumulate for the reversal.

The Pattern

How PAT Shows Accumulation

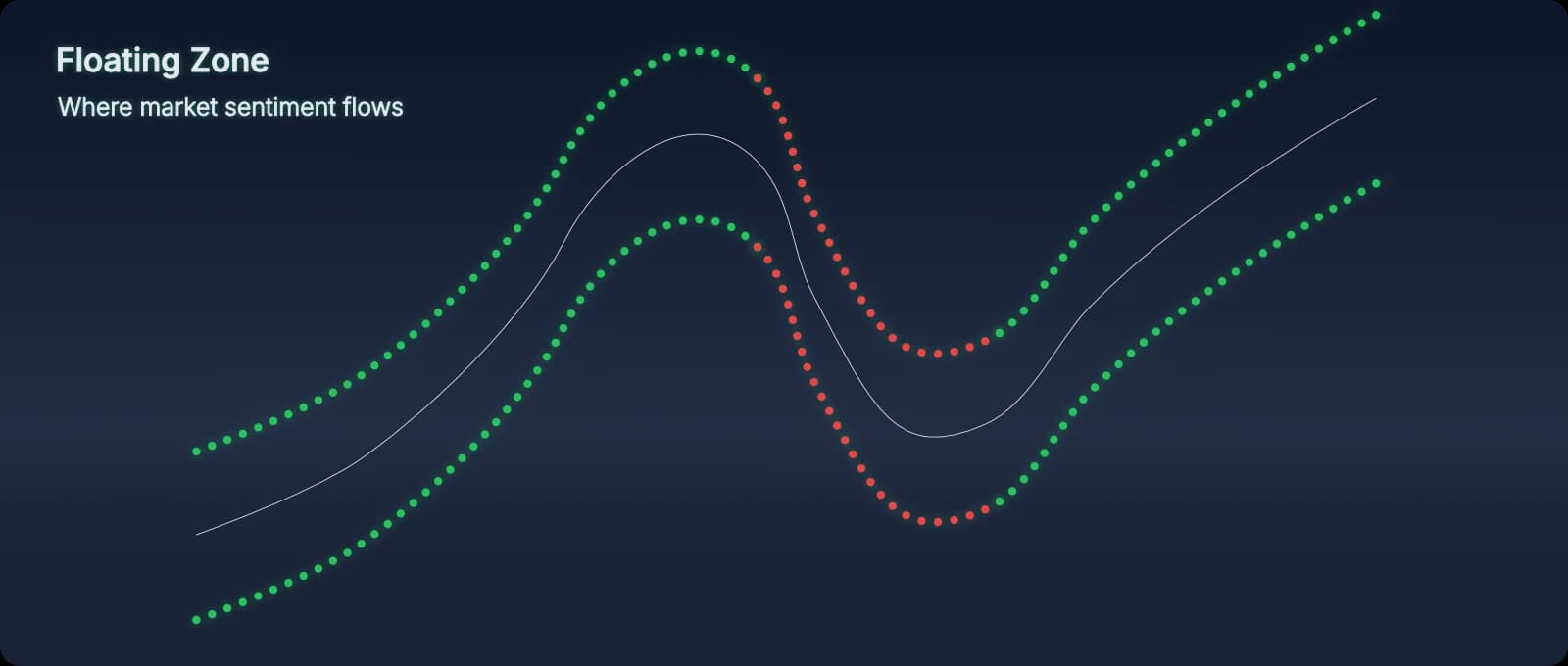

The Floating Zone (also called the River) reveals underlying market sentiment as professional capital builds. When The Floating Zone shows directional flow during price consolidation, you're seeing accumulation in real time.

What to Watch For

- The Floating Zone slopes directionally while price ranges. Price looks choppy, but The Floating Zone shows underlying direction. This is accumulation forming.

- The Floating Zone stays consistent during pullbacks. Price dips, but The Floating Zone doesn't reverse. Professionals are holding their positions.

- The Floating Zone builds momentum before price expands. Accumulation completes when The Floating Zone strengthens and price begins to follow.

Trading Accumulation with PAT

Here's how to use accumulation signals in your trading:

Don't Enter During Accumulation

Accumulation is for observation, not entry. Market makers haven't committed yet. Price can oscillate for extended periods. Wait for the next phase.

Wait for Manipulation Confirmation

After accumulation forms, market makers will test crowd belief through manipulation. Watch for Buffer tests and belief confirmation before entering.

Align with The Floating Zone Direction

If The Floating Zone shows upward accumulation, look for long setups after manipulation confirms. If The Floating Zone shows downward accumulation, look for short setups. Don't fight the underlying sentiment.

Use Accumulation as Context

Knowing accumulation has formed gives you confidence during manipulation. When market makers test belief with stop hunts and liquidity grabs, you'll recognize it as part of the cycle—not a reason to exit.

Common Mistakes Retail Traders Make

- Ignoring accumulation entirely. They wait for "confirmation" (which is actually manipulation or distribution), missing the early context that would prevent costly mistakes.

- Trying to trade the range during accumulation. Price oscillates unpredictably during accumulation. Range-trading strategies often fail because market makers control the boundaries.

- Exiting during accumulation pullbacks. Price dips during accumulation look like reversals, causing retail to exit positions that professionals are strengthening.

- Entering too early without manipulation confirmation. Accumulation can last longer than expected. Entering before manipulation confirms belief leads to frustration and stops getting hit.

From Accumulation to Manipulation

Once accumulation is complete, market makers move to the next phase: manipulation. They'll test crowd belief, trigger stops, grab liquidity, and confirm positioning before the real move (distribution) begins.

What to watch for:

- Price begins to move outside the accumulation range

- Buffers form and get tested

- Pressure Points appear at key levels

- The Floating Zone confirms directional commitment

Learn More About the AMD Cycle

Accumulation is the first phase of the AMD cycle. To understand the complete framework, explore:

- What Is the AMD Indicator? — Complete AMD framework explanation

- The Floating Zone — How PAT visualizes accumulation in real time

- The Manual — Complete walkthrough with chart examples